Up until COVID-19 was declared a global pandemic, the spring real estate market in Toronto (and other major Canadian cities) was set for another record-breaking sales season. February transactions rose 44% year over year and we seemed to be headed back to that Seller’s market that we have become oh so familiar with in recent years. COVID-19 hasn’t just been infecting people – stocks have taken a hit, jobs have been lost, and the future is uncertain. Or, is it?

Take the title of this blog post with a grain of salt – we aren’t suggesting that we have a crystal ball! Nobody does (no, not even the big shot Realtor who sends you bi-weekly E-Spam). Seem as it may that the world has stopped turning, Sellers still need to sell and Buyers still need to buy. Yes, the Sellers and Buyers who are able to will wait this out on the sidelines. No, real estate (despite being deemed an essential service) is not ‘business as usual’. However, there are still motivated Sellers who will see fewer showings from more motivated Buyers, and Buyers who see an opportunity to purchase a property without the stress of multiple offers. And let’s not forget the comfort of an asset that can reasonably be deemed a safe and secure portion of your investment portfolio over the long term.

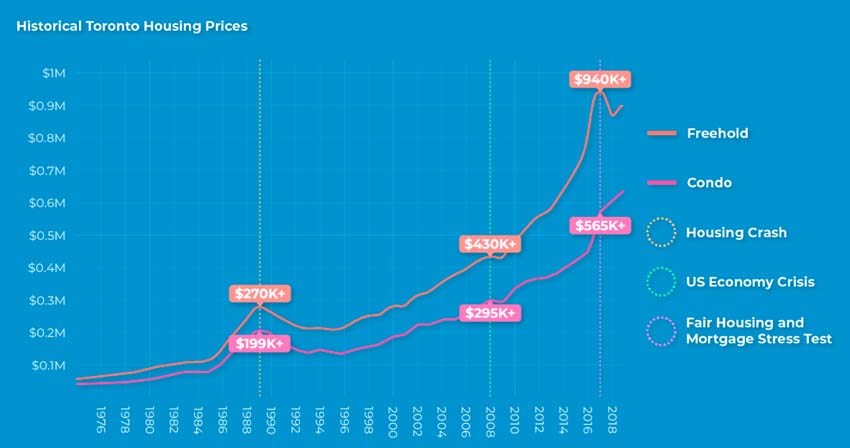

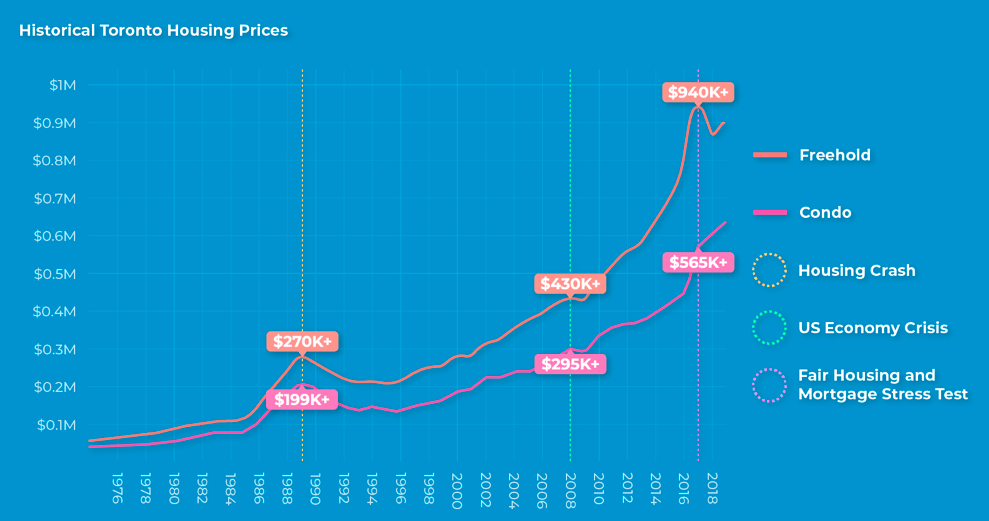

What we do definitively know, is that the real estate market in Canada has shown steady growth and resilience spanning multiple decades and various external forces that have caused momentary declines. It’s easy to forget this in our current era of instant gratification and year over year price appreciation, so, let’s revisit some real examples of past decline and subsequent recovery.

Housing Crash

The late 1980s saw a red-hot housing market, specifically in the GTA where the average house price doubled in just a three-year period. Rising prices drew those to the market who were afraid of missing out, and sky-high mortgage rates (topping out at a whopping 21.46%) put homeowners in handcuffs. Developers started over-building on speculation (today, developers wait to sell a higher share of a project’s units before breaking ground) and then a recession hit. The previous years of overbuilding and overvaluation resulted in 7 straight years of price declines until the GTA got back on its feet.

Bear in mind, other Canadian markets fared well during the same period. Vancouver saw huge growth due to Expo 86 and subsequent migration!

US Economy Crisis

Almost not worth mentioning, Canada largely escaped the major collapse in housing prices that both the United States and Europe experienced. The 2008/2009 recession was relatively short-lived and resulted in what can most accurately be described not as a housing ‘crash’ but rather, a ‘correction’.

Fair Housing and Mortgage Stress Test

In 2016 the government started introducing measures to cool the once again heated market, with the aim to stave off a potential housing crisis. The target of these measures was in large part foreign investment and speculative activity. These measures included the additional 15% land transfer tax for foreign buyers, the introduction of mandated reporting on sales of primary residences to the CRA, stricter rent controls, and the introduction of the lovingly referred to mortgage ‘stress test’ (2017). These measures disqualified many would-be buyers (an estimated 1 in 5) from entering the property market and slowed – if only temporarily – the prevalence of bidding wars and subsequently, rising prices.

Still, CMCH has reported fairly steady price growth in the Canadian housing market in 9 out of 12 quarters since 2016. It is yet to be seen what 2020 will bring us. If there’s been one central theme around COVID-19 it’s one of uncertainty. There is a policy playbook for dealing with financial crises, but until now, there’s been no need to create one for a large-scale economy freeze. We can be certain that there will be a decline in the Canadian real estate market as simulations show a decline in homes sales in the second quarter of this year due to slowed (or shall we say stalled) economic activity. This period in time will teach us important lessons, as have all historic economic cycles.

What we can also be certain of, is that we will recover. Owning a home is a very sought-after ideal in Canada and that’s not going to change. It will take time, but Sellers and Buyers will adjust to the new reality and for now, the market remains stable (due to the decrease in new listings mirroring the decrease in active buyers). This period in time will only further engrain the adage ‘don’t wait to buy real estate, buy real estate and wait’. What we’ve forgotten in our era of ‘house-flipping’ and bidding wars is that the true value of real estate is seen over the long term.

Panic is derived from uncertainty, so we encourage our clients and community to educate themselves and engage in reliable sources that are not hyper-sensationalized. Further, what many charts and graphs fail to illustrate are the nuances of the market – things like segmentation (for instance, the stress test impacted the detached home market negatively and condo market positively) or the fickleness of buying and selling psychology. Engage in conversations with those that you trust, and don’t hesitate to reach out to us with any questions. Remember, we’re in this together.

Sources:

https://precondo.ca/toronto-real-estate-prices *Image Source

https://www.globalpropertyguide.com/North-America/Canada/Price-History

https://www.huffingtonpost.ca/ypnexthome/canadas-housing-performance_b_9266608.html

https://www.theglobeandmail.com/real-estate/mortgages-and-rates/canadas-housing-hangover-real-estate-boom-meet-dot-com-crash/article6867321/